A Retail Rent Joint Value Discovery Tool API and PRRES Conference, 20th January 2020, Canberra…

‘GEM One™ evaluation of an Expert’s Determination’

Don Gilbert is a Specialist Retail Valuer (“SRV”), a 3D Economist and an arbitrator. He provides independent, impartial advice to landlords, prospective investors and tenants.

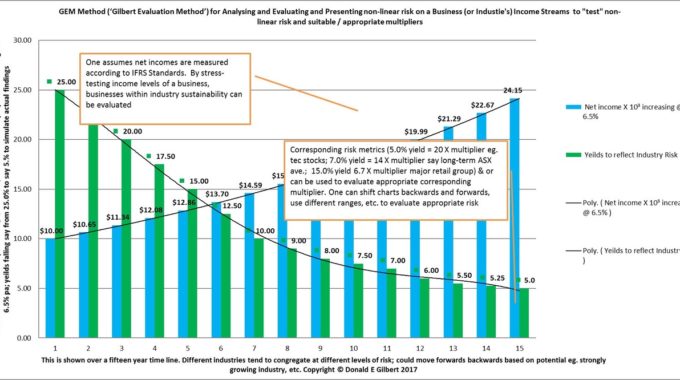

He is also the inventor of the GEM Method of evaluating reasonable retail rent.

TITLE

‘GEM One™ evaluation of an Expert’s Determination’ © Donald E Gilbert as Trustee Gilbert Family Trust 2019

TARGET AUDIENCE

Retail Tenants, Landlords, Investors, Valuers & Property Professionals, Banking and Finance Industry, and other professionals eg. perhaps investment advisors

INTRODUCTION

# 19/2 Am making several small changes to this article.

Several weeks ago, I posted a short note on LinkedIn. I suggested that several new applications had come to mind, including the possibility that one could evaluate the veracity of a Specialist Retail Valuer’s (‘SRV’) determination using my software.

BACKGROUND

Our Profession I have suggested / I believe / I have witnessed is far from independent, impartial, objective.

In the absence of being independent, I feel they lack forensic evaluation skills.

Consider the behaviour that has been driven by or in the residential property market. Where has The Brain’s Trust been in that sector ………….. ?

Well, I was one that teased some of it out and gave it some direction – see LinkedIn articles.

So lets flick back into my software invention to evaluate the reasonable rent of ONE retail lease. It involves a complex he said she said argument that can and does arise between landlords and tenants.

Why did I set aside commercial industrial residential consultancy? Boring.

So as our Beta Testing has progressed; and it is progressing, new applications have come to light. And one of them was to “stress-test” a SRV’s Expert Determination of a supermarket style of business in a Neighbourhood Shopping Centre.

It was beautiful …………..

19/2 Under the various State Tenancy Laws the SRVs follow similar requirements in making a determination (ref. S 29 Queensland Act):

(1) In making a determination of the current market rent, the specialist retail valuer—

(a) must determine the rent—

(i) on the basis of the rent that would be reasonably expected to be paid for the retail shop if it were unoccupied and offered for leasing for the same or a substantially similar use for which the shop may be used under the lease; and

(ii) on the basis of gross rent less lessor’s outgoings payable by the lessee under the lease; and

(iii) on an effective rent basis; and

(b) must not have regard to the value of the goodwill of the lessee’s business or the lessee’s fixtures and fittings in the retail shop; and

(c) must have regard to—

(i) the terms and conditions of the lease; and

(ii) submissions and responses from the lessor and lessee about the market rent of the shop; and

(iii) the other matters prescribed by regulation.

(2) In this section—

effective rent basis, for the determination of rent under a retail shop lease, means determining the rent on the basis of taking into account all associated advantages and disadvantages under arrangements made between the lessor and lessee that reflect the net consideration from the lessee to the lessor under the lease and associated arrangements.

Market Behaviour in Neighbourhood Shopping Centre arena

The local market behaviour in regard to Neighbourhood Shopping Centres (and this is Industry Wide) has been to “engineer” up rents to Engineer Up purported market value.

And to dump it on the market.

Well if one does not do one’s due diligence with a competent expert, who understands these metrics backwards, one might have bought a lemon. And not an Investment Property! And this seems to have been the case.

The Expert’s Rental Determination; and GEM One™ methods, systems, processes and procedures (forensic evaluation) wherein all Steps 1 – 6 are “talking” to one-another and stress-testing the data metrics

The Expert went through the hum-drum of the business, the building, the terms of the lease, the behaviour of the retail supermarket industry etc.

He went into the leases, rents, the rental evidence, he went through the makings of incentives in the market place, but what the Expert did not do is realize that GEM One™ methods, systems, processes and procedures (the forensic evaluation) were going to put his analytics through the hoop as well!

His primary analysis involved the evaluation of 7 comparable leases.

The Profits Method threw out the possibility of considering a new lease. Why? Shop now too big; impact of new stores, impact of larger centre in catchment, impact of Woolworths Coles Aldi having been granted relaxed trading hours, etc. change in technology, changes in consumer tastes, tighter margins, etc.

Step 1 Option 1 of GEM One™ started linking the store performance metrics to the gross rent and or a key industry benchmark. It was presented to the valuer and highlighted the problem.

Step 2, being in a smaller centre could not really be used.

In Step 3, we started comparing and linking store performance metrics with that of the actual shop, including to present sales required to pay the SRV’s rent as determined (remember we are testing the veracity of his determination) at various industry benchmark levels!

Step 4 linked all the known occupancy costs on a “gross rental” basis, including rent shown on an effective rental basis aka adjusted for incentives.

The SRV’s “average” rent that he adopted from the evidence he used, was that occupancy costs of all his evidence on the equivalent of “engineered” rents equated to 5.41% of turnover.

If one adjusted the rents for incentives that “average” equated to 4.43% of future estimated maintainable sales.

Astonishingly the SRV’s evidence ranged from 4.14% of turnover to 8.23% of turnover; I would have # 19/2 given little weight to 6 out of 7 bits of evidence unadjusted for the incentives. He could not use them as evidence. # 19/2 Notwithstanding that the software modelling allows one to link at the rents to the best industry benchmarks available to assist one with one’s decisions.

On a “gross effective” basis, I would only have used # 19/2 given weight to 4 / 7 bits of the evidence, after testing the veracity of them being “reasonable” rents.

Steps 5 and 6 linked each bit of evidence back to the shop’s size and the store performance level of the actual shop whose rent was being determined.

The rental range of all the evidence adopted used by the Specialist Retail Valuer including evidence adjusted for incentives ranged from $54,045 per annum gross effective to $95,520.

The evidence matching the “face” rent used by the SRV ranged from $76,545 to $95,520 per annum, (average $83,225 = $470.00 per square metre = 5.31% of future maintainable sales) aka the ‘problem child’ for the new buyer if centre is sold on; whereas the real rent, the effective rent, the rent without the Ponzi value ranged from $54,045 to the same $95,520 (average $67,458 = $360.00 per square metre = 3.75% of turnover).

Having “stress-tested” the evidence, 6 / 7 should have to have been discarded on the Face Rents used by the SRV, whereas 5 / 7 adjusted for incentives could have been used (in my opinion) on an effective rental basis, obviously which would have produced a vastly different outcome.

But watch in the case of the latter for rents on lease renewal!

SRV’s Expert Determination

One could be forgiven that Australia did not does not have a quite significant crisis looming on our residential sector that will also flow into consumption.

The SRV’s determination was on the upper end of the rental range having used knowingly technically flawed data.

The determination was made in such a way as to obfuscate the reader, and the proffered rent which must include Landlord operating expenses, was presented without outgoings as if the rent was $20,000 lower, but it was / is not. It was over $90,000.

All pointers including our prediction mode which includes landlord and tenant evidence, the “averaged” effective rent came out at circa $65,000 gross with Landlord operating expenses.

In order to stress test the metrics for ONE Retail Lease in regard to what the reasonable rent ought to be must be good for Valuation Standards, I feel it shows up the underlying “culture” behind Australian valuation practice.

The software will also be capable of stress-testing the veracity of a sample of leases for a whole shopping centre investment purchase sale.

I believe this is very very valuable Intellectual Property aka a Body of Knowledge (BOK), in which I have connected all pivotal points of valuation appraisal practice.